The sky-high sea freight of 10,000 US dollars is here!

Gina Chen

2020-11-19 10:17:23

Under the severe impact of the epidemic this year, global trade has fallen into a slowdown. After experiencing a sharp drop in shipping demand in the first half of the year, it has only slowly recovered in recent months. It has also brought a strong shipping sector. The shipping index has risen by 6.84%, ranking first in the market. Many companies such as COSCO Shipping, COSCO Shipping Holdings, and COSCO Shipping Development have daily limit.

However, the demand for logistics is booming and the capacity is declining, leading to a sharp increase in container freight. The freight rate of the West American route has increased by about three times compared with the beginning of the year. The freight of South American routes has also skyrocketed, and almost no routes are spared.

With the gradual resumption of work in Europe and the United States and the lifting of the ban, the port container trade is gradually recovering. In addition, during the epidemic, the ports around the world cannot operate normally, resulting in poor return of containers scattered around the world, making it difficult to find a container in China and nowhere in Europe and the United States.

Recently, the market has seen a sky-high sea freight of 10,000 US dollars. Industry insiders pointed out that the global shipping market will continue to be "difficult to find a ship and a container". The mainstream shipping companies have booked space until late December. It is predicted that high freight rates will continue until around the Spring Festival.

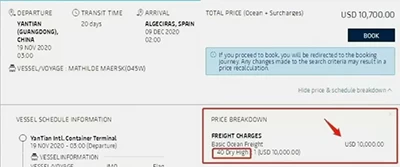

The sky-high freight rate of 10,000 US dollars "turned out"

Recently, the freight rate from Yantian to Algeciras has reached as high as 10,000 USD. A Maersk spokesperson said: “From July to October, all the containers that can be found have been rented out, but the leasing market has dried up. There are no empty boxes."

Shanghai, Ningbo, Qingdao are still short of containers, and freight forwarders are experiencing the high freight rates of 4000 in South America, 5000 in East US, and Southeast Asia, which have skyrocketed by 1000 overnight, and there is no space or cabinet.

This epidemic has brought different heavy blows to shipping companies, freight forwarders and foreign trade personnel.

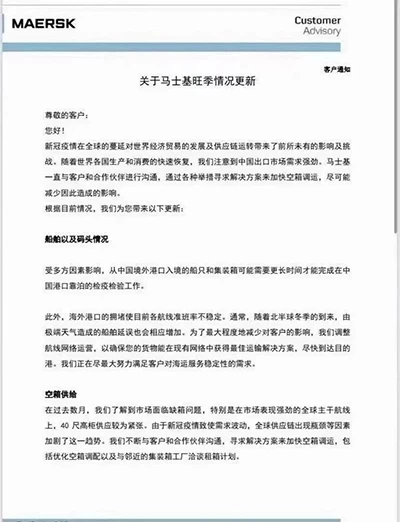

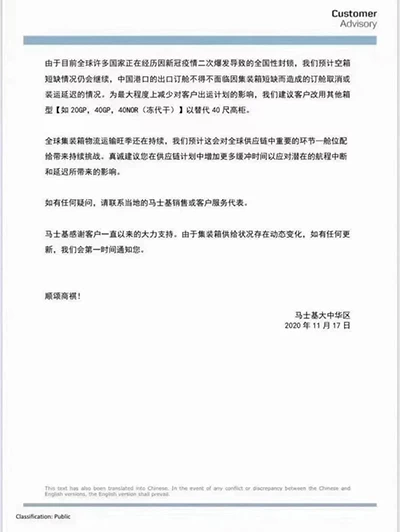

Maersk also spoke on the 17th, saying that in response to this phenomenon, it will take a long time to restore the normal transportation status in the past.

Coupled with the arrival of the peak consumption season, it is still a high probability event that shipping prices will maintain a high level in the next period of time.

After reading the notice from the shipping company, let's focus on it!

The status quo of the shipping market will hardly be eased this year.

The probability of missing boxes will continue...

The increase in freight rates will continue...

Shipping delays will continue...

The probability of liquidation will continue...

After reading the notice from the shipping company, let's focus on it!

The status quo of the shipping market will hardly be eased this year.

The probability of missing boxes will continue...

The increase in freight rates will continue...

Shipping delays will continue...

The probability of liquidation will continue...

Multiple factors push up freight rates

As for the reason for the recent boom in the shipping market, industry insiders say that it is the result of multiple factors. On the one hand, due to the global epidemic, demand was suppressed in the first half of the year, and many businesses had the need to replenish inventory; on the other hand, a large number of epidemic prevention materials were exported, and the demand for home shopping in overseas markets increased.

In addition, the poor turnover of shipping containers has further pushed up freight rates.

In a recent survey conducted by investors, CIMC said: “Currently, our company’s container orders have been scheduled to around the Spring Festival next year. The demand in the container market has increased significantly recently. The reasons are that first, affected by the epidemic, exported containers are scattered all over the world. The return is not smooth; second, foreign governments have introduced financial stimulus such as the epidemic relief plan, which has led to super strong performance on the demand side (such as living and office supplies) in the short term, and the housing economy is booming. It is currently judged that the “lack of boxes” situation will continue for at least some time. But the whole year of next year is not clear."

According to data from the Container Trade Statistics Corporation (CTS), the growth rate of global container shipping trade volume remained flat in July 2020, and the cargo volume accelerated in August and September. The volume growth in September was nearly 8% year-on-year. Judging from the year-on-year growth rate of the east-west trunk routes, the demand on the two major routes continued to expand, and the US route even expanded to a growth rate of more than 20%.

The research report pointed out that in the medium term, the replenishment of inventory in the US retail and wholesale industry has not yet ended, and the inventory cycle will last for at least half a year, laying the foundation for continuous improvement in demand.

The achievement of RCEP can significantly reduce tariff and non-tariff trade barriers, further strengthen the position of the manufacturing center in the Far East, and lay the foundation for the growth of regional maritime trade.

In addition, from the supply side, the proportion of shipbuilding orders held is at the lowest level in history. Even considering the impact of newbuilding, the delivery deadline is after the second half of 2023, and there is no basis for large-scale launch of capacity.

Industry insiders bluntly said, "It is still hard to say that the shipping industry has recovered in an all-round way. Overall, the global epidemic is a negative factor for the shipping industry. The epidemic has changed the cargo shipment cycle, and traditional shipping seasonal characteristics are not so obvious."

It's hard to find a box in China, where is the box?

At this time, in large ports such as Qingdao, Lianyungang, Ningbo and Shanghai, the extreme shortage of containers is causing delays in ship berthing operations and the ports are under pressure. On the far side of the ocean, many European and American ports have experienced serious congestion due to the surge in containers.

The main reason for this is that the epidemic has affected normal global trade. It is expected that after the epidemic is brought under control, the hard-to-find domestic situation will gradually disappear.

According to data released by the National Bureau of Statistics, in the first 10 months of this year, my country's imports and exports increased by 1.1% year-on-year, which is better than the growth of global trade. Fu Linghui, spokesperson for the National Bureau of Statistics, said that this fully reflects China's greater foreign trade potential and greater resilience.

It is understood that due to the paralysis of production capacity in many countries, China, which was the first to get rid of the impact of the epidemic and whose production is on track, has become the center of the world's factories in a short time. Orders from Southeast Asian countries such as Bangladesh, Vietnam, and India have been transferred to China. As a result, the number of goods shipped from China has surged.

Data show that since July, my country's container export volume has grown rapidly, and since October, container throughput has a trend of further acceleration. According to data released by the China Ports Association, the container business of the coastal ports under key monitoring has further accelerated. In October, the container throughput of the eight major hub ports increased by 11.1% year-on-year, a new high this year.

Looking at the world, it is not difficult to find that the global market is seriously uneven.

The United States Port Trucking Association (HTA) stated that in the ports of Los Angeles and Long Beach alone, 10,000-15,000 containers were stranded at the terminals, causing the current cargo transportation of the ports of Los Angeles and Long Beach to "nearly paralyze"; West Coast ports and Chicago are also right The large number of empty containers brought about by the surge in imports is helpless.

Not only in the United States, but also in Australia and the United Kingdom, the backlog of a large number of empty containers is getting worse. It is estimated that the number of empty containers in Australia alone exceeds 50,000.

The number of ships coming out of China is relatively large, but the number of ships coming out of places such as Europe and the United States is small. In this context, China ships containers one by one, but few return, causing a large accumulation of European and American containers. A box is hard to find.

Orders surge, trade volume far exceeds expectations

Whether the container goes or returns has brought a lot of trouble to various countries.

It is understood that due to the rising epidemic in Europe and the United States, there is a shortage of labor, cars, and frames in ports. The on-time rate of ships has dropped from 85-90% in June to 56% in September. The average delay of shipping schedules is five days and is on time. The rate continues to decline. According to statistics, the waiting time for ports on the west coast of the United States is 4-5 days, while that for Auckland, New Zealand is more than 10 days. Ferresto in the United Kingdom has announced that it will stop accepting empty containers due to overcrowding.

At the same time, the exemption period that prevails in foreign ports is also much shorter than before. The free storage period of two weeks or more no longer exists, and many ports directly collect rents.

In China, due to the emergency of many ports and containers, some shipping companies have begun to substantially increase freight rates and begin to charge various additional fees.

However, this did not have a major impact on my country's exports.

At present, my country's import and export trade has accelerated growth for 4 consecutive months. According to statistics from the General Administration of Customs, China’s import and export value has shown a “V” trend since the beginning of the year. Due to the outbreak of the epidemic from March to May, international trade has been weak and import and export value has continued to grow negatively. Since June, with the control of the epidemic and the resumption of production, the import and export amount has improved significantly. For the first time in two years, the amount of imports and exports has increased for four consecutive months, and the growth has accelerated.

The trend of container throughput and import and export volume is highly consistent. In September, it was 24.53 million TEUs, an increase of 7.63% year-on-year. It was also a positive growth for four consecutive months from June to September, and the bottom rebound trend was obvious.