Commercial laser sales boost Lumentum

US firm’s business remains dominated by communications and sensing, but ultrafast and fiber lasers are in demand.

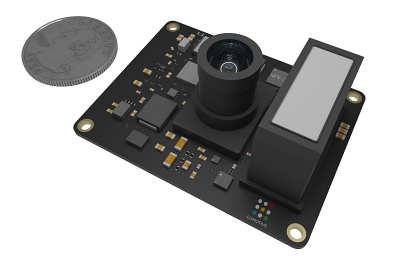

VCSEL array meets beam-steering chip

California-headquartered Lumentum has posted quarterly revenues of $506 million, thanks partly to a strong rise in sales of fiber and ultrafast lasers for industrial applications.

The San Jose firm’s business remains dominated by applications in optical communications and 3D sensing, but at $57.2 million, the commercial lasers division's revenues were up 16 per cent year-on-year and at a long-term high.

CEO Alan Lowe told an investor conference call that fiber lasers made up the largest chunk of that total, but that sales of ultrafast lasers had more than doubled over the past 12 months.

Applications in electric vehicle battery welding, displays, and solar cell production are three of the areas driving the growth, with Lowe confident that demand will emerge in other markets.

Sensing swings

On the 3D sensing front, Lumentum’s share of business with key customer Apple has ticked down over recent quarters as the consumer electronics giant sought to even up its supply from rival Coherent, but Lowe pointed to new business emerging with other customers.

“At this year's Consumer Electronics Show we had strong customer engagement across all applications of 3D sensing and lidar, including from numerous automotive companies,” said the CEO.

Exactly when that translates into more meaningful volumes remains to be seen, with non-consumer 3D sensing sales (in automotive and Internet of Things applications) standing at only $3 million in the latest quarter.

However, Lowe did indicate that this figure should start to climb to significantly higher levels from this summer onwards. “[Automotive] lidar adoption is becoming a reality in China,” the CEO told investors. “It’s going into vehicles that are going out on the road.”

Lumentum supplies vertical cavity surface-emitting laser (VCSEL) arrays to Chinese lidar firm Hesai, which recently signed a deal with Changan Automobile, one of the oldest and largest vehicle brands in China.

On the core communications side, Lumentum’s sales rose 13 per cent year-on-year to $449 million in the quarter - although some temporary softness in the end market for cloud computing has prompted the firm to once again trim sales expectations for the fiscal year ending in June.

Supply chain constraints are also continuing to hinder sales, although Lumentum says that situation is generally improving. The company is also ahead of schedule with respect to making savings following last year's acquisition of NeoPhotonics, with that and other cost control measures now expected to result in higher profit margins this year.

AI impact: less copper, more optics

Looking longer-term, Lowe and his executive team expect the deployment of artificial intelligence (AI) and machine learning technology in cloud infrastructure - partly through new chatbot applications like ChatGPT and Google’s “Bard” equivalent - will lead to more demand for optical components in data centers.

The emerging AI architecture is a “tremendous opportunity”, said the CEO, as it will drive a need for faster speeds, and for more copper connections transitioning to optical. “It means more volumes and a need for a broader offering,” Lowe added.

Lumentum said it expects sales in the March quarter, which is typically characterized by a seasonal dip, to fall to between $430 million and $460 million, and to remain at that level in the June quarter that marks the end of the firm’s fiscal year.

Those figures imply that full-year sales will turn out somewhere in the region of $1.8 billion. That compares with the range of $1.9 billion to $2.05 billion previously communicated, largely a result of the softer business in cloud computing.

• Following the latest update, Lumentum's stock price held steady at around $61, equating to a market capitalization of just over $4 billion.