2023 Deep UV LED Market Trend and Product Analysis- Ready for a Comeback

According to TrendForce’s 2023 Deep UV LED Market Trend and Product Analysis, the pandemic woes in China affected both supply chains and new project investments across the UV-A LED sector in 2022, where the market demand for PCB exposure machines and LCD lamination equipment—related to consumer electronics—dropped dramatically. In the UV-C LED sector, most home appliance manufacturers delayed product development plans due to weak consumer spending, indicating their lower willingness to introduce UV-C LED products. Further, UV LED manufacturers adopted low pricing strategies with hopes of increasing orders and revenue, throwing UV-A/UV-C LED prices into chaos. Overall, the UV LED market value for 2022 plunged to USD 207 million.

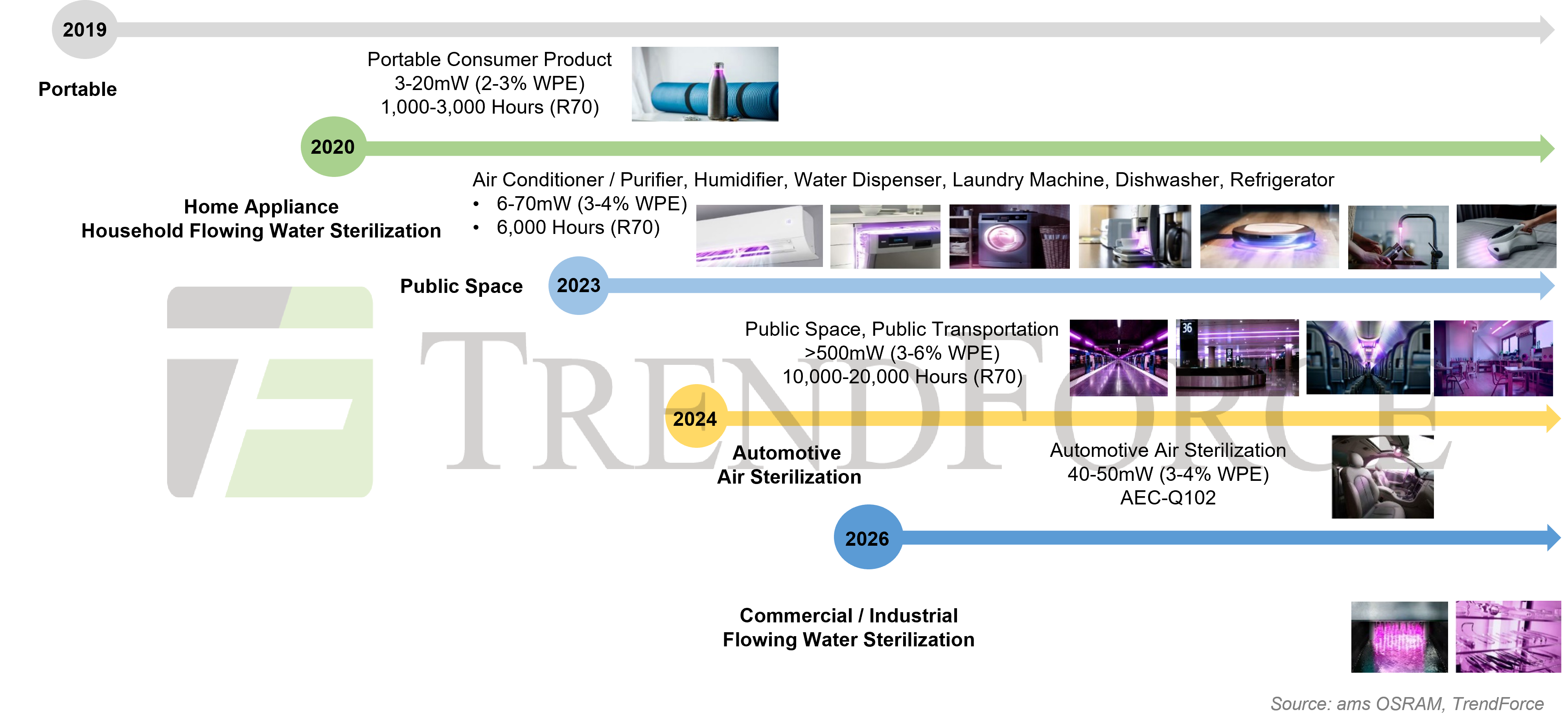

Moving in to 2023, major UV LED manufacturers will maintain the target on double-digit growth. Moreover, projects involving UV-C LED applications are likely to be relaunched thanks to less strict COVID-19 restrictions in China. UV-C LED manufacturers are also racing to develop air disinfection, household water purification and industrial / commercial water markets. To meet the requirements of high power disinfection, the said companies will roll out single-chip high power products and novel integrated packages. The UV LED market value is jumping to USD 411 million in 2027 with a 2022-2027 CAGR of 15%.

2022 UV LED Player Revenue Ranking

Seoul Viosys continued to generate the highest UV LED revenue between 2019 and 2022 in consecutive, securing its top position. Benefiting from growth in UV-C LED revenue, Nichia came in second, followed by Asahi Kasei (Crystal IS) in third place thanks to orders from Japanese home appliance brand DAIKIN. By developing UV Micro LED business, Nitride Semiconductors saw only a 10% dip in UV LED revenue throughout 2022.

Product Specifications and Reliability

As TrendForce reveals, manufacturers are racing to develop UV-C LEDs with higher optical power. Currently, UV-C LED’s optical power reaches 40-120mW (350mA). Regarding single-chip products, Nichia, ams OSRAM, LITEON, UVT, and Stanley have announced ≥100mW UV-C LED products. In particular, LITEON’s mass produced UV-C LED (single chip) boasts an optical power level of 175mW (600mA) thanks to the company’s exceptional light extraction patents. Asahi Kasei (Crystal IS), Violumas, and NKFG plan to roll out their ≥100mW UV-C LEDs in 2H23 with better product reliability, namely a lifetime of ≥10,000 hours (R70).

Deep UV LED includes UV-B LED and UV-C LED, and that various applications have constantly emerged. However, the coexistence of products with high and low quality has made the market slightly chaotic. Nonetheless, Seoul Viosys, Nichia, ams OSRAM, Asahi Kasei (Crystal IS), LITEON, and Samsung LED have released high optical-power UV-C LEDs with high reliability, and put more effort into the home appliance, industrial and commercial, and flowing water sterilization markets. It is thus believed that they will help create more applications for the UV-C LED market. As TrendForce predicts, due to intense price competition, the UV-C LED market is likely facing a major shuffle in the coming years, where suppliers launching products with high quality and cost competitiveness will gain the lead.

The report “2023 Deep UV LED Market Trend and Product Analysis” explores the market value, product specifications in major UV-C LED manufacturers, prices, reliability, and application market trend. The report offers comprehensive insights for readers regarding development and marketing of deep UV LED applications.